Managing payroll can often be a tedious task: a complex and time-consuming task for payroll teams. While payroll teams are meticulous, the task itself is so tedious that human errors creep in. That’s why automated payroll management is necessary. Especially in SME businesses where even business owners get involved in payroll, it is a must.

But not just any payroll software! Because payroll is much more than just calculating monthly salaries. Incentives for sales force, overtime, and compliances– like minimum wages and other statutory compliances–make it complex.

With OpportuneHR Payroll Software, organizations can streamline their salary management processes and ensure compliance with ease. You can automate the entire process of payroll generation.

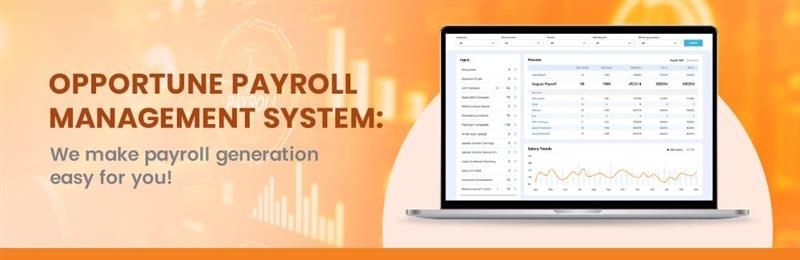

Here are some key highlights of our efficient payroll management system:

One Click Payroll Generation

OpportuneHR makes payroll generation incredibly simple. With just one click, you can generate payroll reports anytime you need. This flexibility allows you to choose any day for salary disbursement, ensuring that your employees are paid on time. The software is designed for speed and accuracy, and eliminates and reduces human errors that can often occur in manual payroll processing. Because everything is automated, no manual calculations are required. Which guarantees accurate payments.

Highly Configurable Payroll Management System

One of the standout features of OpportuneHR is its highly configurable payroll system. It allows you to define various payroll rules and parameters according to Indian payroll compliances.

You can set salaries and variable pays based on grades and job roles, manage flexible CTC structures, and handle payroll taxes, and employee benefits seamlessly. The ability to customize payslips according to your organization’s requirements adds an extra layer of convenience.

In short, you can configure the entire payroll function with ease.

Comprehensive Payroll Dashboard

The payroll dashboard in OpportuneHR is designed to provide a clear overview of all payroll management needs at a glance. You can easily track new joinings, exits, full and final settlements (F&F), arrears, increments, and more. Monthly payroll comparisons and trends help HR managers make informed decisions, while alerts for non-compliances ensure that you stay on top of legal requirements.

Payroll Controller Features

OpportuneHR also includes robust payroll controller features that enable you to review the final salary register before locking payroll for the month. This functionality provides an essential check to ensure accuracy before disbursement. Additionally, the software integrates with your accounting system for seamless journal voucher (JV) entries, making payments and quarterly TDS management straightforward. Payroll cost analysis allows businesses to assess their expenses effectively.

Employee Self-Service

OpportuneHR is cloud-based payroll software, which makes employee self-service possible. Employees can see their payroll records, tax documents, monthly salary and incentive details with ease. On their own individual dashboards on the ESS portal!

Ensure Consistency in Salary Disbursement with payroll management

In today’s competitive job market, retaining talented employees is more important than ever. One significant factor that plays a crucial role in employee retention is the consistency of salary disbursement. When employees receive their salaries promptly and accurately, it builds trust and promotes job satisfaction. Let’s explore how effective payroll management can contribute to employee retention.

Here is an update on how OpportuneHR Payroll software contributes to this cause–

1. Payroll Generation: Fast, On Time, and Accurate

The foundation of a reliable payroll system starts with efficient payroll generation. Here are some essential components:

- Generate Pay Register: A comprehensive pay register helps track employee earnings, deductions, and net pay, ensuring transparency.

- Publish Release & Hold Salaries: Timely release of salaries is critical. Employees should be informed in advance about salary disbursement dates to avoid any confusion.

- Arrears & Increment Computation: Managing arrears and increments accurately is vital for maintaining employee morale. An efficient system ensures that any outstanding payments are calculated correctly and disbursed on time.

Discover how one click payroll generation help in other ways to streamline your business operation.

2. All The Key Payroll Functionalities

Beyond just processing salaries, a robust payroll system encompasses various functionalities that cater to employee needs:

- Employee Investment Declaration: Allowing employees to declare their investments can help in tax planning and increase their satisfaction with the payroll process.

- Loans and Advances Computation: A clear and systematic approach to handling loans and advances fosters trust. Employees appreciate transparency in how these are calculated and disbursed.

- Full and Final Settlement: When an employee leaves the organization, a smooth full and final settlement process reflects professionalism and respect, enhancing the overall employee experience.

- Variable Adhoc Payment: Providing flexibility for adhoc payments accommodates employees’ needs and strengthens their loyalty to the organization.

3. Taxation & statutory Compliances

One aspect that makes payroll tedious is complex calculation of large amount of tax data: tax calculations and tax deductions as per individual employee’s investments, grade and other factors can overwhelm even the best payroll professionals.

Compliance with taxation regulations is another critical aspect of payroll management. Here is how OpportuneHR payroll software helps you:

- PF Challan, PT & ESIC Registers: Maintaining records for Provident Fund (PF), Professional Tax (PT), and Employee State Insurance Corporation (ESIC) ensures legal compliance while building employee confidence in the organization’s payroll practices.

- Quarterly TDS & FORM 16: Timely processing of Tax Deducted at Source (TDS) and issuing FORM 16 is essential for employees’ tax planning and reinforces the organization’s commitment to compliance.

- JV Passing to Accounting System: Smooth integration of payroll data with the accounting system ensures that financial records are accurate and up-to-date, reflecting the organization’s financial health.

- Bank Statements & Lock Salary: Regular reconciliation of bank statements with salary disbursements provides assurance of accuracy, while locking salary amounts in advance helps in budget management.

Consistency in salary disbursement is not just about paying employees on time; it encompasses a complete payroll management system that addresses various aspects of employee finances. By implementing efficient payroll processes, you can enhance employee satisfaction, reduce turnover rates, and cultivate a committed workforce. In a world where talent is the most valuable asset, ensuring consistent salary disbursement is a pivotal strategy for successful employee retention.

The above list is just a glimpse of the amazing powers of the Opportune payroll management system.

Once you use it, you will know the depth of micro features and its capabilities.

That’s why our customers say–

OpportuneHR is the most reliable payroll management system!

And there is a reason for such confidence. OpportuneHR stands out as one of the best payroll software solutions in India, boasting impressive capabilities that can handle 35,000+ employees on a single instance and generate over 200,000 payslips each month.

To recap, here’s why OpportuneHR deserves your attention–

Amazingly Fast, Accurate & Compliant Payroll

One of the key features that make OpportuneHR a top choice is its speed and accuracy. The software is designed to be always ready and operates in real-time, allowing you to disburse salaries efficiently. With the capability to generate 35,000 payslips in less than four hours, OpportuneHR ensures that payroll processing is not only fast but also error-free. All compliance calculations are handled seamlessly, giving you peace of mind and ensuring adherence to regulations.

Opportune Has Employee-Friendly Payroll Features

OpportuneHR prioritizes the needs of employees by offering flexible salary structures tailored to individual preferences. The platform includes features such as a tax stimulator, investment declaration options, and access to both monthly and annual payslips. Additionally, employees can easily submit reimbursement claims, making the payroll process more transparent and user-friendly.

It Is The Finance Team’s Best Friend

For finance departments, OpportuneHR simplifies payroll management with its user-friendly interface. The software allows for one-click payroll processing, which saves time and reduces manual effort. Key features include an intuitive dashboard for monitoring payroll status, options to lock payroll, and comprehensive compliance checks. You can also generate pay registers and accounting journals with ease, while non-compliance reports help you stay on top of regulatory requirements.

Conclusion: Opportune payroll management system is a must for growing businesses!

In summary, OpportuneHR is an exceptional payroll solution provider for businesses looking for reliable payroll software. With its robust capability to manage large employee bases, lightning-fast processing speeds, and employee-friendly features, it addresses the diverse needs of organizations while ensuring compliance and accuracy. Investing in OpportuneHR means investing in a hassle-free employee payroll experience that benefits both finance teams and employees alike.

Explore how OpportuneHR can transform your payroll processes today!