Payroll software is a solution used by HR professionals to manage the entire life cycle of payroll operations end-to-end. It makes sure employees are paid timely and helps track expenses down to the last rupee.

An online payroll software also helps with tax deductions and ensures the company knows the new tax laws further avoiding tax-related issues. Review the final salary register & lock payroll for the month.

All with a few clicks!

Payroll: An essential part of business.

An employee is motivated and happy when they receive salary on time and without any errors. A payroll software helps with that and avoids the hassle of clerical errors.

Payroll software is easy to use, saves time and is affordable. It helps reduce hours spent on calculating employee hours, holidays, incentives, wages, taxes and withholdings, especially for small businesses.

In large businesses, there are a large number of employees, so having the payroll software becomes a necessity. Payroll software allows human resource managers to work at their own pace and make changes quickly if the need arises.

When an HR manager does this process manually, they will have to spend a huge chunk of their time, tracking each and every detail of the employee. But with the Payroll software, all of this is automated, thus saving time. A software might be more expensive than hiring an employee, but the extra bucks are worth the spending, considering the saved hours and stress.

Here’s why you should use a payroll software:

It helps with fast, on-time and accurate payroll generation. It helps the HR department manage full and final settlements of the employees and avoids the hassle of keeping a physical record and ensure timely payments.

As mentioned in the introduction, it helps with taxation and compliance and fills tax forms. It also Calculates Deductions and Net Income of the employees. With employee self-service, it allows employees to keep a check on their holidays, payments, and other records.

Since the system is based on the cloud, it can be used by anybody in the company and collaboration is also easier. Most importantly, it prevents misclassifications.

Various functions and benefits of payroll software:

- Linking payroll software with time recording – Linking the timesheet with a payroll software helps keep track of an employee’s working dates, holidays, etc. This saves time and ensures there is no miscalculation of dates and is legitimate.

- Using payroll software for reporting – A payroll software gives an in-depth study of the employee and helps track the hours put in by them. It gives quality reports which include department wise divisions, with contracts and terms included.

- Storing personnel records – Organisations tend to keep a track of records of the employees, for e.g., keeping track of their birthday so they can celebrate it to boost morale. With the OpportuneHR payroll system, you can avoid spending on another application to keep a track.

- Using a payroll system to plan future costs –Since payroll packages provide forecasts, you can use these to plan staff costs and budgets by entering hypothetical numbers to see the exact total cost of an employee.

- Minimize Errors – The payroll system is automated and that helps a great deal to ensure the process of calculating data is hassle free and easy to use. This saves time and resources of the company.

- Security of Payroll Data – Payroll data is confidential since it contains important details of an employee. With the help of the payroll system, the authorized personnel can lock down the data and ensure that it does not land into the wrong hands.

- Provides Tax Updates – Keeping a track of new rules is very important for an organisation. Filing taxes on time and correctly is also important. A payroll software helps a great deal and gives reminders to ensure timely filing of taxes with the latest updates.

- Enhances Productivity and improves efficiency – If you use the program to supervise and maintain your payroll system, then you may carry extra performance on your business. A payroll software program like OpportuneHR speedily compiles all the statistics needed to generate well-timed payroll slips and month-to-month salaries, which saves time and resources of the business to apply somewhere more important.

- Managing Large Numbers – When a business expands its set up, the number of employees also increases. A payroll system helps manage their data and ensures timely payments. This helps a great deal with expansion, efficiency and affordability in the long run.

- Technical support –With a strong software one might need a strong support system in case there are any issues with it. Providing timely solutions helps improve the experience of the management as well.

- Based in the Cloud – Since the software is cloud based, an employee can access their account anywhere in the world, with due access and diligence.The cloud will contain all necessary details of the employee and help track them on the spot.

Is a payroll software worth the investment?

With a payroll software, the HR department is one step above the rest. Many organisations are adopting automated processes and are going digital. Keeping track of things has never been easier. A payroll software when it comes down to it, is a basic necessity for any organisation to ensure a happy team.

It is apparent that payroll processing software program has great advantages to enhance your payroll system’s efficiency, productivity, and accuracy. It can assist accounting corporations, streamline the process and use their abilities to offer well-timed solutions. It lessens the workload of enterprise organisation.

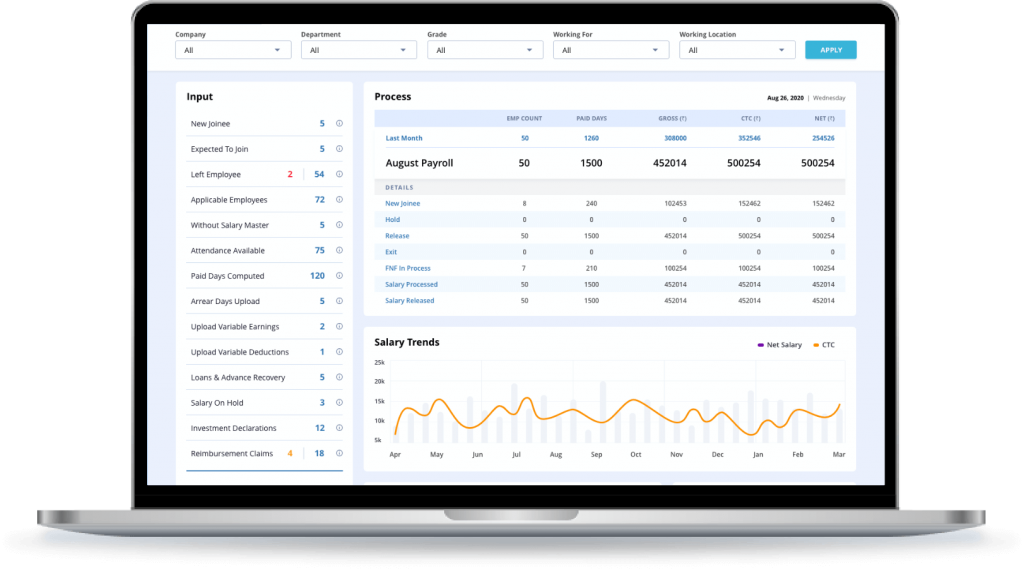

Here are some highlights from OpportuneHR Payroll software

OpportuneHR comes with in-built intelligence to compute and perform–

- Minimum wages

- State wise compliance [PT slabs]

- HRA computation as per metro & non metro city

- PF, ESIC, Statutory Bonus computation as per compliances

- Tax calculator for tax planning as per investment declared by employees

- Tax computation different slabs as per PAN availability [non pan card holders higher tax is deducted]

- Formula based salary structure as per grades & working locations

- OT computation

- F&F preparation including [recoverable loans, advances & asset]

- F&F payments as per exit policy [leave encashment, notice period, arrears]

- Bank statement for disbursement

- Salary comparison report previous month to current month

- Hold salary status

- API to integrate payroll data with accounting cost centers

- User rights & workflows for payroll generation & disbursements

- Payroll maker & checker can be assigned.

- Increment history is maintained.

- CTC can be revised in between financial year & date of publish can be pre-defined