Business owners have a general sense of most HR terms, but still some questions keep coming again and again.

In particular, the relationship between payroll and HR often creates confusion.

We often hear questions like –

- What is the role of HR in payroll processing?

- Does HR include payroll?

- What is the connection between HR and payroll?

- What are the advantages of integrating HR software and payroll software?

Let’s address these questions in this blog post.

What exactly is the role of HR in payroll processing?

The role of HR in payroll processing is crucial. HR (Human Resources) plays a significant role in ensuring accurate and timely payment to employees.

Here are some specific responsibilities of HR in payroll processing:

- Employee Data Management: HR collects, verifies, and maintains employee data such as personal information, employment details, tax withholdings, and benefits enrolment.

- Time and Attendance Management: HR tracks employees’ working hours, leave records, overtime hours, and other attendance-related information. This ensures accurate calculation of wages.

- Payroll Calculation: HR works closely with finance departments, or outsourced payroll providers, to calculate employee wages based on the agreed-upon pay rates, deductions, bonuses, and allowances.

- Compliance with Employment Laws: The human resource department ensures that the HR and payroll process comply with labour laws regarding minimum wage requirements, overtime regulations, tax withholdings, and other applicable legal obligations.

- Payroll Administration: HR handles administrative tasks related to payroll processing, including preparing pay cheques or electronic transfers for employees, distributing payslips or statements, and addressing any payroll-related inquiries or discrepancies.

- Benefits Administration: In most organisations, HR manages payroll and other responsibilities such as health insurance, retirement plans, and other voluntary deductions that impact payroll processing.

- Reporting and Record-keeping: Automated payroll processing solutions through an integrated system eliminates the need for manual calculations. It also reduces paperwork. This saves time for HR professionals and minimizes errors. It also helps in faster processing of salaries and reduces administrative costs.

Overall, the role of HR in payroll processing involves–

Managing employee data accurately and ensuring compliance with relevant laws and regulations to facilitate smooth salary payments to employees.

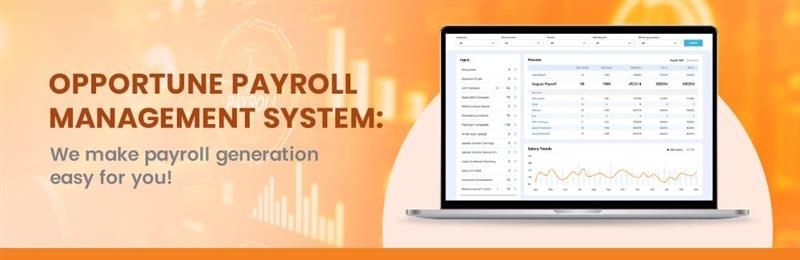

Does HRMS include payroll software?

Yes, HRMS (Human Resource Management System) typically includes a payroll module. HRMS is a software or system that helps organisations manage various HR functions and processes efficiently. While the specific features and capabilities may vary depending on the HRMS software, it commonly includes a payroll module as an integral part.

The payroll module within an HRMS enables organisations to streamline and automate the payroll processes. It allows HR professionals to accurately calculate employee wages, process payments, handle tax withholdings, deductions, bonuses, and maintain compliance with employment laws and regulations.

By integrating payroll within an HRMS, organisations can have several advantages:

- Centralized Data: The integration of payroll with other HR functions in an HRMS enables centralized employee data management. This reduces redundancy of data, improves accuracy, and also ensures consistency across different processes.

- Time and Cost Efficiency: Automating payroll processes through an integrated system eliminates the need for manual calculations. It also reduces paperwork. This saves time for HR professionals and minimizes errors. It also helps in faster processing of salaries and reduces administrative costs.

- Compliance Management: An HRMS with a payroll module ensures adherence to labour laws and regulatory requirements related to payroll processing compliance. It assists in accurate tax calculations, generating necessary reports like tax filings or year-end documents, thus facilitating compliance with legal obligations.

- Employee Self-Service: Many modern HRMS systems provide self-service portals for employees. These portals allow them to access their payslips, view tax information, update personal details relevant to payroll processing (such as bank account information), and submit reimbursement claims online.

- Reporting and Analytics: An integrated payroll module within an HRMS provides comprehensive reporting capabilities. It generates reports on various aspects of payroll such as expense analysis, salary distributions, overtime tracking, etc. It is a great help to management in making informed decisions.

So we can say, while not all HRMS systems may include a payroll module, it is a common and valuable component of an HRMS. Its integration within the system offers several benefits in terms of efficiency, accuracy, compliance, and employee self-service.

What is the connection between HR and payroll function?

The connection between HR (Human Resources) and payroll is closely intertwined. HR and payroll work in collaboration to ensure accurate and timely payment to the workforce.

Key connections between HR and payroll:

- Employee Data: HR is responsible for collecting, verifying, and maintaining employee data such as personal information, employment details, tax withholdings, benefits enrolment, and changes in salary or position. This employee data is vital for accurate payroll processing.

- Salary Determination: HR plays a role in determining salaries based on various factors like job responsibilities, experience levels, market trends, internal policies, and negotiated agreements. The payroll department relies on HR’s input to calculate wages accurately.

- Time and Attendance: HR tracks employees’ working hours, leave records, overtime hours, and other attendance-related information. This data is crucial for calculating wages correctly in the payroll solutions.

- Payroll Processing: Once HR has collected relevant employee data and attendance records, it shares this information with the payroll department or outsourced providers responsible for processing payroll.

HR ensures that the necessary calculations regarding wages, bonuses, deductions (such as taxes or benefits), and compliance with labour laws are accurately implemented in the payroll system. - Compliance with Employment Laws: Both HR and payroll team must work together to ensure compliance with labour laws related to minimum wage requirements, overtime regulations, tax withholdings, benefits contributions, etc.

HR provides guidance on legal requirements while the payroll department ensures that these requirements are met during salary processing. - Communication with Employees: When it comes to communicating changes in compensation or benefits to employees (such as promotions or pay raises), it is typically handled by HR.

Payroll relies on HR to provide accurate information about any updates or changes that impact an employee’s salary. - Problem Resolution: In the case of any discrepancies or issues related to salaries or payments, both HR and the payroll department collaborate to investigate and resolve them effectively.

HR communicates with employees to understand their concerns, while payroll investigates the technical aspects of the problem. - Reporting and Record-keeping: HR and payroll departments work together to maintain accurate records of payroll transactions, employee earnings, tax filings, benefits contributions, and other relevant information. These records are essential for audits, financial reporting, and compliance purposes.

Overall, the connection between HR and payroll is crucial for ensuring accurate, compliant, and timely payment to employees while maintaining proper documentation of all payroll-related activities.

Is payroll handled by HR?

Payroll is typically handled by the HR (Human Resources) department in established organisations. The HR department plays a central role in managing various payroll activities.

Here’s why payroll is handled by HR :

- Employee Data Management: HR is responsible for collecting and maintaining employee data, including personal information, employment details, tax withholdings, benefits enrolment, and changes in salary or position. This data is essential for accurate payroll processing.

- Time and Attendance Management: HR tracks employees’ working hours, leave records, overtime hours, and other attendance-related information. This data is used to calculate wages accurately in the payroll system.

- Payroll Calculation: HR works closely with the finance department or outsourced payroll providers to calculate employee wages based on pay rates, statutory deductions (such as taxes or benefits), bonuses, and allowances. HR ensures that all relevant factors are considered during the calculation process.

- Compliance with Employment Laws: HR ensures that employee payroll processes comply with labour laws regarding minimum wage requirements, overtime regulations, tax withholdings, benefits contributions, and other applicable legal obligations. Staying updated with changes in employment laws is crucial for HR to maintain compliance.

- Payroll Administration: HR handles administrative tasks related to payroll processing, such as preparing pay cheques or electronic transfers for employees, distributing payslips or statements, addressing any payroll-related inquiries or discrepancies from employees, and maintaining proper documentation.

- Communication with Employees: HR communicates important information about compensation changes (such as promotions or pay raises) to employees. They inform employees about how their salaries are calculated and provide assistance if there are any questions or concerns regarding pay.

- Problem Resolution: In the case of any discrepancies or issues related to salaries or payments raised by employees, it is often the HR department that investigates and resolves them effectively in collaboration with the payroll department.

- Reporting and Record-keeping: HR maintains accurate records of payroll transactions and generates reports for management’s review or external audits. These reports may include payroll expenses, tax filings, year-end reports and other relevant information.

While the HR department is typically responsible for handling payroll, it’s important to note that some organisations may have a dedicated payroll department or outsource their payroll processing to external service providers.

In such cases, HR still plays a crucial role in coordinating and providing the necessary data and information for accurate payroll processing.

FAQs About Role of HR in Payroll Processing

1. What is payroll processing in HR?

Payroll processing in HR refers to the steps involved in calculating employee salaries, deducting taxes and benefits, and ensuring employees are paid accurately and on time.

2. How do HR and payroll work together?

Payroll software can take help of HR software to share accurate data such as attendance, leave, and benefits. This can help payroll software calculate employee salary correctly with accurate bonuses and deductions.

3. What are the key payroll compliance challenges for HR?

Some of the payroll compliance challenges for the HR department include keeping up with changing labour laws, ensuring accurate tax deductions, filing returns on time, and maintaining proper employee records to avoid legal issues.

4. How does HR coordinate with finance for payroll processing?

HR provides updated employee data and salary details, while the finance team handles fund disbursement, tax payments, and reporting to ensure smooth and compliant payroll processing.